When we think about financial services, our association relates to banks. Traditional banks. Banks take care for this for centuries. No matter what modern channels we use – ATMs, online banking or mobile banking – it is still very likely, that there is traditional bank behind, taking care of these services. And PSD2 or in general open banking just might change this forever as it will be much easier for players out of banking industry (for instance Fintechs, non-banks) to enter this till now highly fenced territory. There is no doubt, that these newcomers will play significant role in the future of financial landscape. And strict banking regulations are finally also closer to them than ever before.

PSD2/Payments Services Directive 2 is the revised payments services directive with main goal to drive innovation, support increased competition and transparency across the whole European payments market. According to this new directive, banks will be obliged to enable TPPs (Third Party Providers) access to customer’s account (which is called XS2A), with his/her consent of course. What XS2A will mainly bring, is enablement of provisioning of entirely new types of service that are regulated under PSD2—third party payment initiation (provided by Payment Initiation Service Providers or PISPs) and third party account access (provided by Account Information Service Providers or AISPs.

As there is now only few months left until PSD2 will become effective (it must be implemented in national legislation in EU member states no later than January 13, 2018) and currently it seems it represents as many challenges to bank as opportunities. Some countries are already going faster and further than PSD2 requires, like UK with its Open Banking.

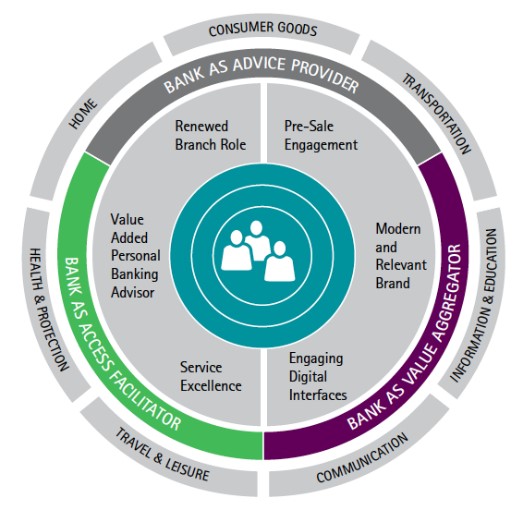

There are disruptive impacts of PSD2 and open banking for banks – there certainly will be revenue losses from card-based transactions fees, banks will also lose “ownership” of customers “ownership”, their insight and so on. But this is how many banks perceive it. Open banking is not as a threat of getting rid of banks’ “traditional rights”, it is not shortcut for new market players to get banking licence either. With API focused digital ecosystem for instance, banks should see it as enormous opportunities – starting with the opening them a chance to partners with the whole range of complementary players, many of those have been so far perceived as outsiders or even their opponents. Within digital ecosystem, incumbent banks still enjoy many powerful competitive advantages over new market entrants. What they have is trust, built-up brand profile and capabilities to properly handle and deal with tons of data. They have fault-proven and pre-existing architecture and infrastructure for that. But they simply need to take strategic decision on how far they want to go with open banking, what the strategic and technology implications of their chosen approach would be, and what challenges they would need to overcome in order to move ahead. Whatever strategic direction banks go for, they have to centralize their position and play an aggregator role at the heart of their customer’s daily lives.

Open banking is opening up also (or maybe particularly) towards non-banks. It is easier for them than ever before to enter financial market. With APIs, non-banks can have access to financial services without having headaches of dealing with compliance and regulatory, which banks are required to do. Third parties (non-banks) can initiate online payments to retailer, e-merchant or any other, simply and fully online from payer’s bank account. These third parties already today have the capacity to extract data from customer’s account and get transaction history and balances (when acting as AISP). When properly utilizing this data, this is tremendous opportunity to provide completely new services based on extracted data and gathered information.

As PSD2 is probably one of the greatest opportunity and huge threat to the banking industry at the same time. Banks can become content provider, data holder and handler, they can be platform provider and aggregator of customer oriented services. And thus, these are tremendous opportunities for positive revenue impacts. If is however fully up to banks, if they will take “wait and see” approach, or will consider lessons learned from other industries. At the same time, same opportunities are being opened up also for other, non-financial players. Within winners will be those, who will be the fastest in adopting a business model and future applications to API economy.

Why New Frontier Group?

New Frontier Group is declared a market leader in IDC MarketScape 2017 with its iBanking solution, provides complete end-to-end support not only to bear with PSD2 and open banking opportunities, but to get step ahead with taking full advantage of its opportunities.

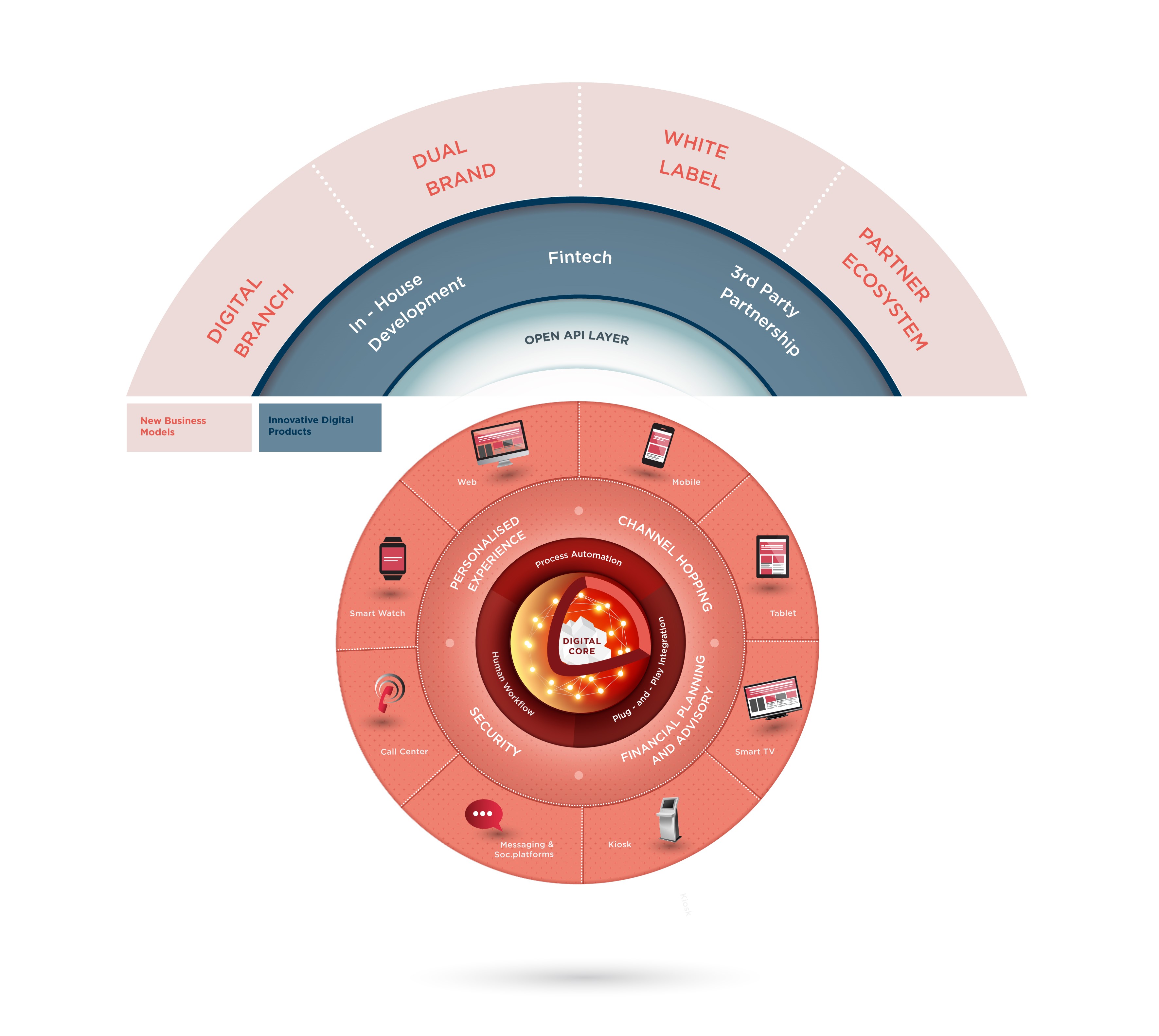

Independent of which strategic approach bank decides to follow, NFG provides full services and own products support to properly address open banking based strategic decisions: be it with enabling full digital branch, establishing new brand and deliver new revenue models or enabling white-labelling services via digital platform.

Independent of which strategic approach bank decides to follow, NFG provides full services and own products support to properly address open banking based strategic decisions: be it with enabling full digital branch, establishing new brand and deliver new revenue models or enabling white-labelling services via digital platform.

New Frontier Group is your trusted partner throughout every step of the whole open banking journey. Do not hesitate to check how we could help you get started.

Blog Contributors

Matej leads New Frontier Slovenia sales and business development activities.

Has over 15+ years of experience in IT, from leading IT departments, leading sales teams to participating in complex management consulting projects. His expertise is in financial industry with focus on digital transformation, open banking and new digital business models.