Give Your Customers

The Best Digital Experience

You want to provide customers with the best possible experience when they interact with your bank. Therefore, our FINTENSE ,Omnichannel digital banking platform allows you to customize interaction on any digital touchpoint and fully automatize the digital processes to make customers lives easier.

Engage and Enable

Your Customers

FINTENSE, Omnichannel digital banking platform supports many standard and advanced digital banking functionalities, available on all channels. Some of those are available for anyone who downloads the app and other only for the Bank’s customers, after login.

Online Account Opening

- Optichannel Customer Enrolment process – Start on Web, finish on Mobile

- ID Scan & Face Recognition

- Based on End2End automation of Customer facing processes

- Real-Time Account Opening

- KYC and AML processes included

- Digital Signature available

- Document storage

- Simple integration and orchestration of external systems

- Account opening without visiting a branch or call center calls

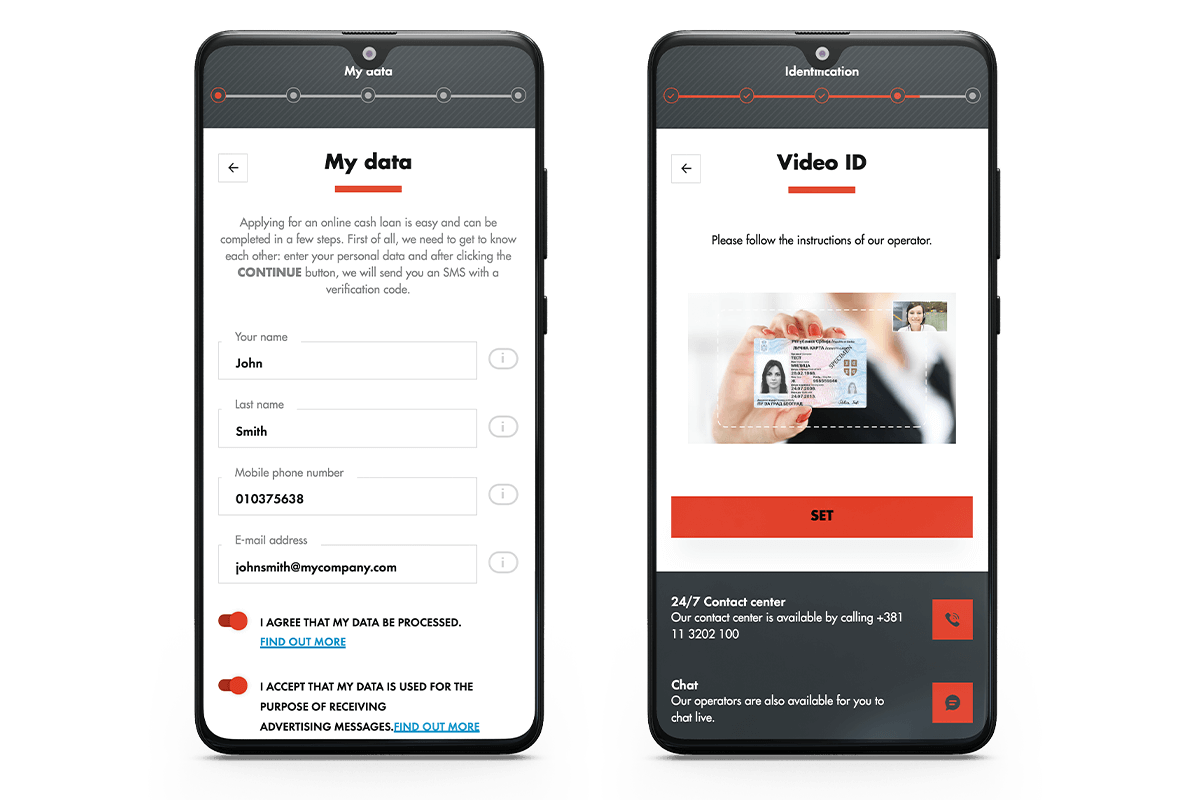

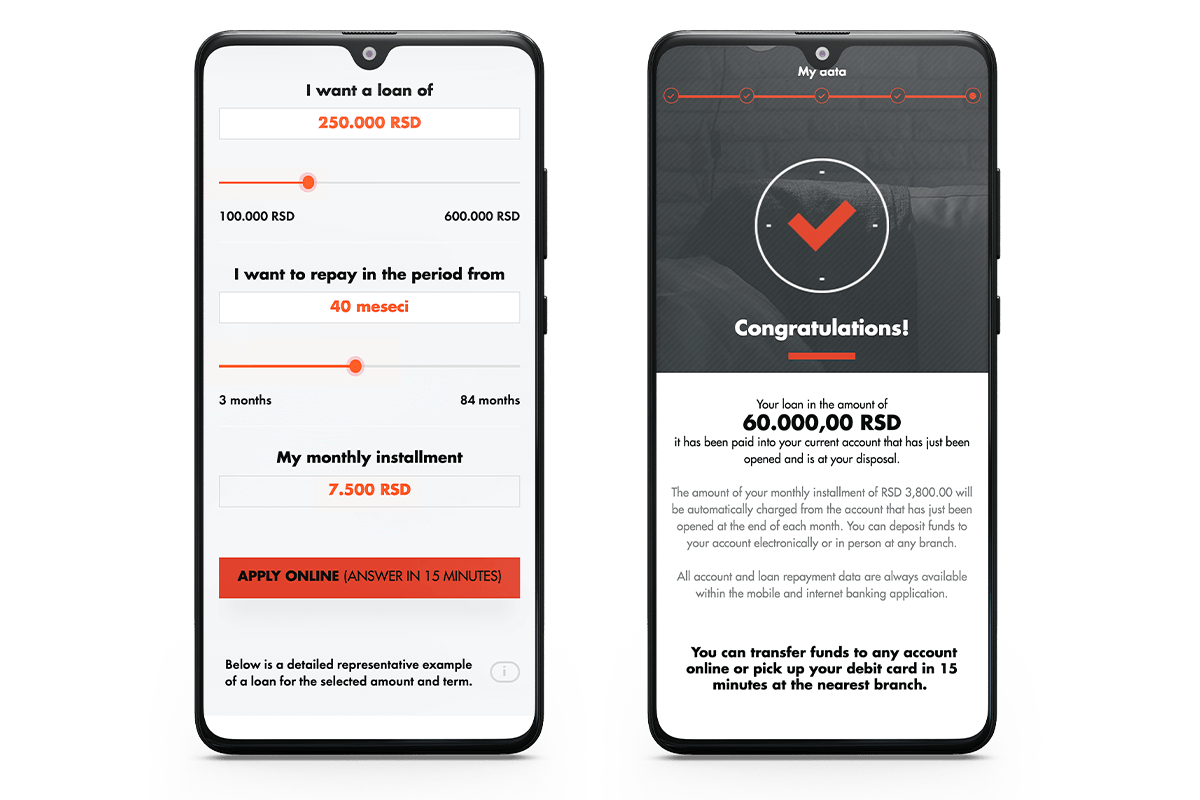

Online loans for both clients and non-clients

- Complete loan origination without visiting the bank branch

- Lean and simple User Experience throughout the process

- Document exchange through the app

- Automated or video call identification

- Advanced electronic signature

- Account opening in the background (for non-clients)

- Compliance with all legal and regulatory requirements

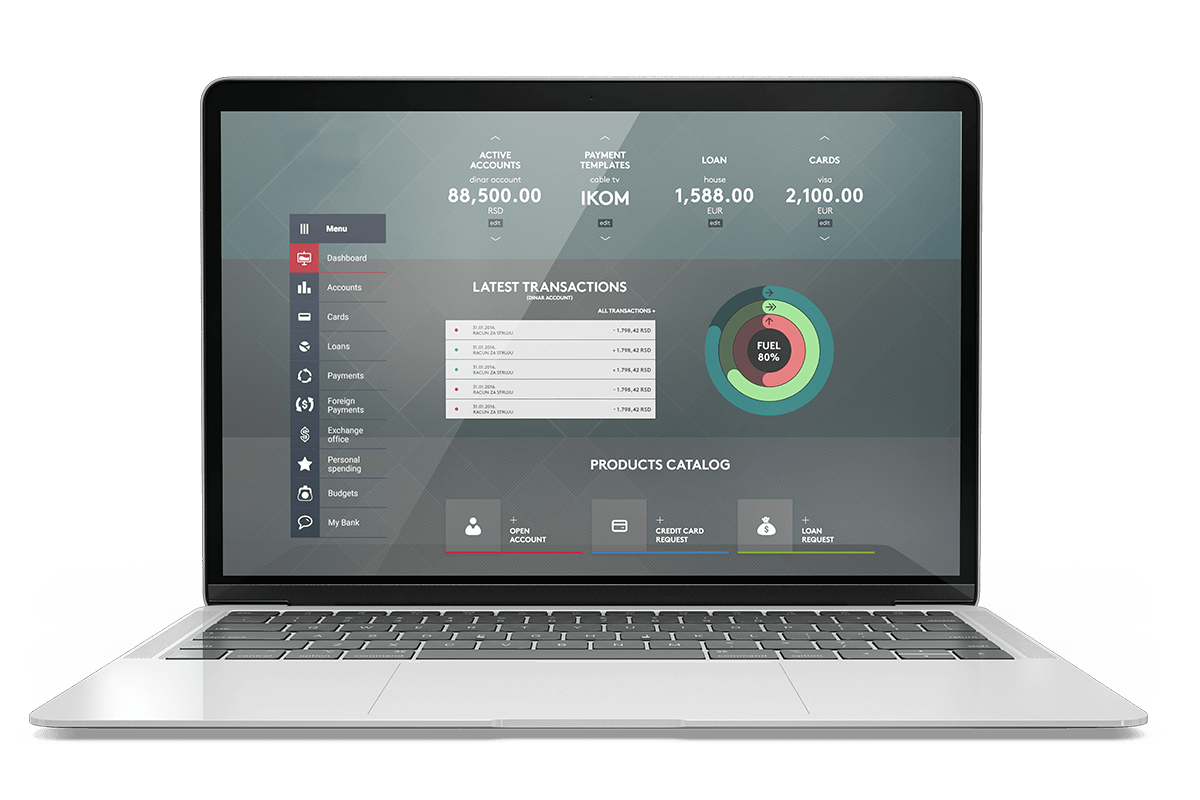

Full Retail/Individual banking services

Overview of all accounts and cards: balances, details, transaction histories, statements, graphs

- Internal transfers between customer’s accounts

- Domestic and international transfers

- Saved/predefined payment beneficiaries

- Currency exchange

- Peer-to-peer payments: transfers between individuals

- QR Code payments

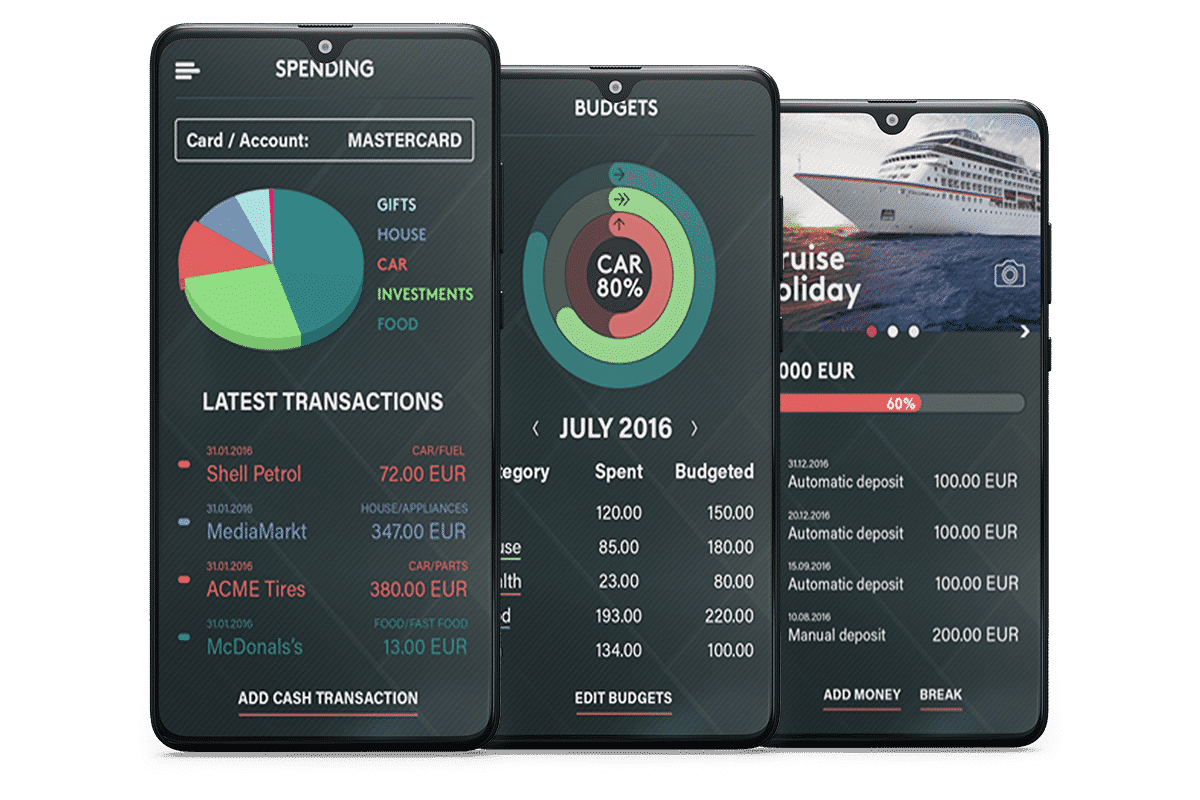

Personal Finance Management

Built-in PFM module allows the customers to automatically categorize all their expenditures and income from their accounts and credit/debit cards, based on the descriptions of the transactions and/or the merchant categories (for card payments).

The categorization of the transactions is done on multiple levels:

- Automatically, using the default system rules applicable to all customers

- Automatically, using the personal rules of each customer (which override the system rules)

- Manually, by changing the category (if needed)

The module also supports budgeting per month per category and automatic tracking of the expenses in those categories, including the overspending alerts.

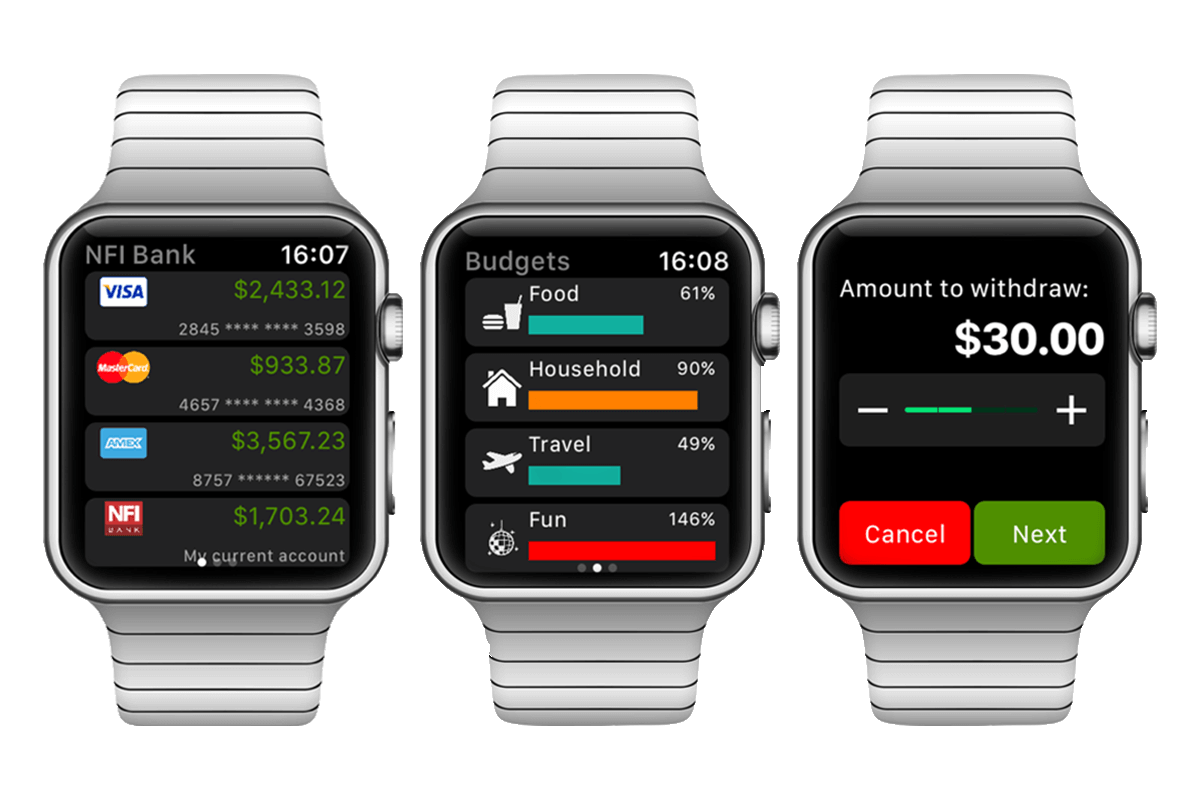

Apple Watch App

For quick banking on the go, the following features are available on Apple Watch:

- Account and card overview (balances, transaction history)

- Peer-to-Peer (P2P) payments (send money to a phone contact)

- Cardless ATM withdrawal

- Viewing Personal Finance Management (PFM) budgets for the current month

- ATM & branch map

- Interactive notifications

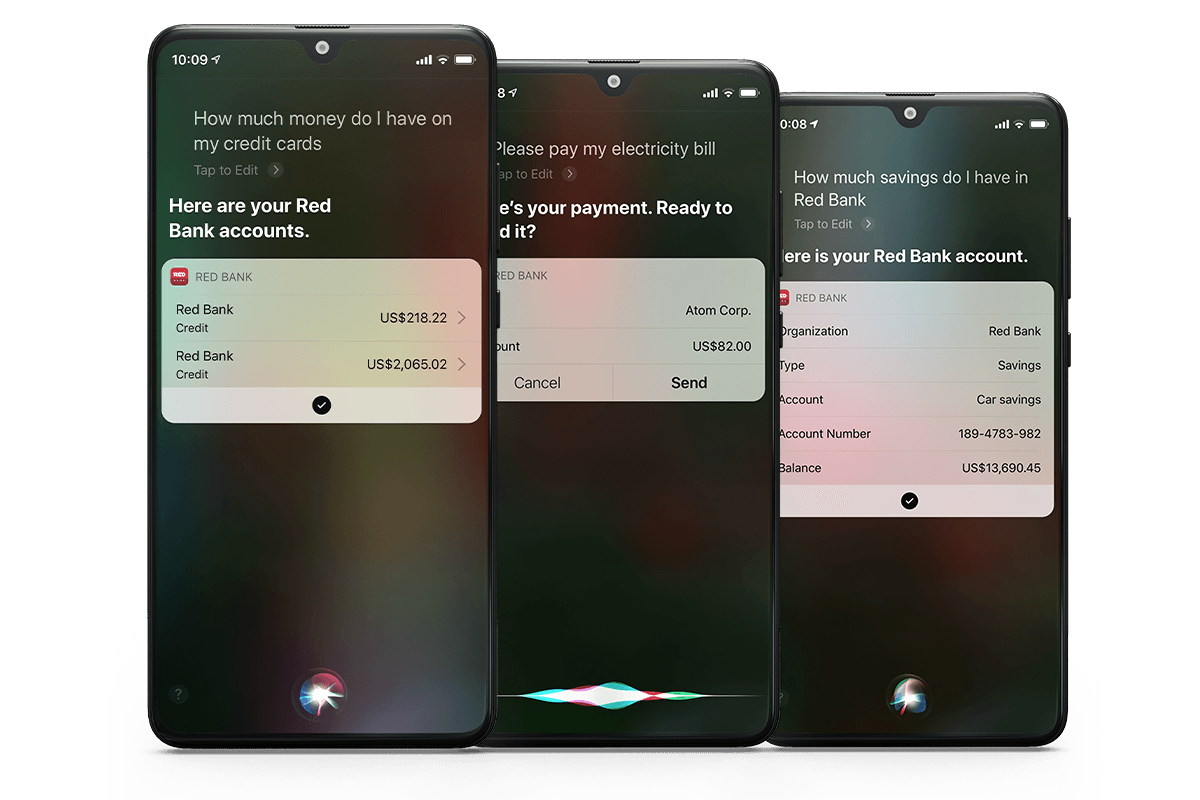

Smart communication

Voice assistants on iOS and Android platforms, Siri and Google Assistant, can read and display information about customer’s products, as well as perform multiple types of transfers:

- Get account balances (checking, savings, loan, etc.)

- Pay utility and other types of bills

- Send money to another person

- Send request to receive money from another person

- Internal transfers and currency exchange

Augmented Reality

Robo Advisor

The Bot is an artificial intelligence-driven software product that simulates natural language communication and enables customers to get answers and explanations through written or spoken conversation based on specific business scenarios.

- The Bot fully understands English and different local languages

- Conversations between the Bots and clients are interactive and seem like communication among people

- Available on Facebook, Viber, WhatsApp, and other Social Messaging Platforms

- CRM integration–working times and appointment scheduling

- Information regarding loans and credit cards, credit calculator

- Voice to Voice in English and other languages

- P2P transaction via a phone number or QR code, paying bills

Empower Your Organisation

Under the hood, FINTENSE, Omnichannel digital banking platform has state-of-the-art Digital Core middleware as the hub for all integrations and Fintech services. It controls all front-end channels, handles automatic and human workflows, personal finance management processing, predictive analytics and other advanced tasks.

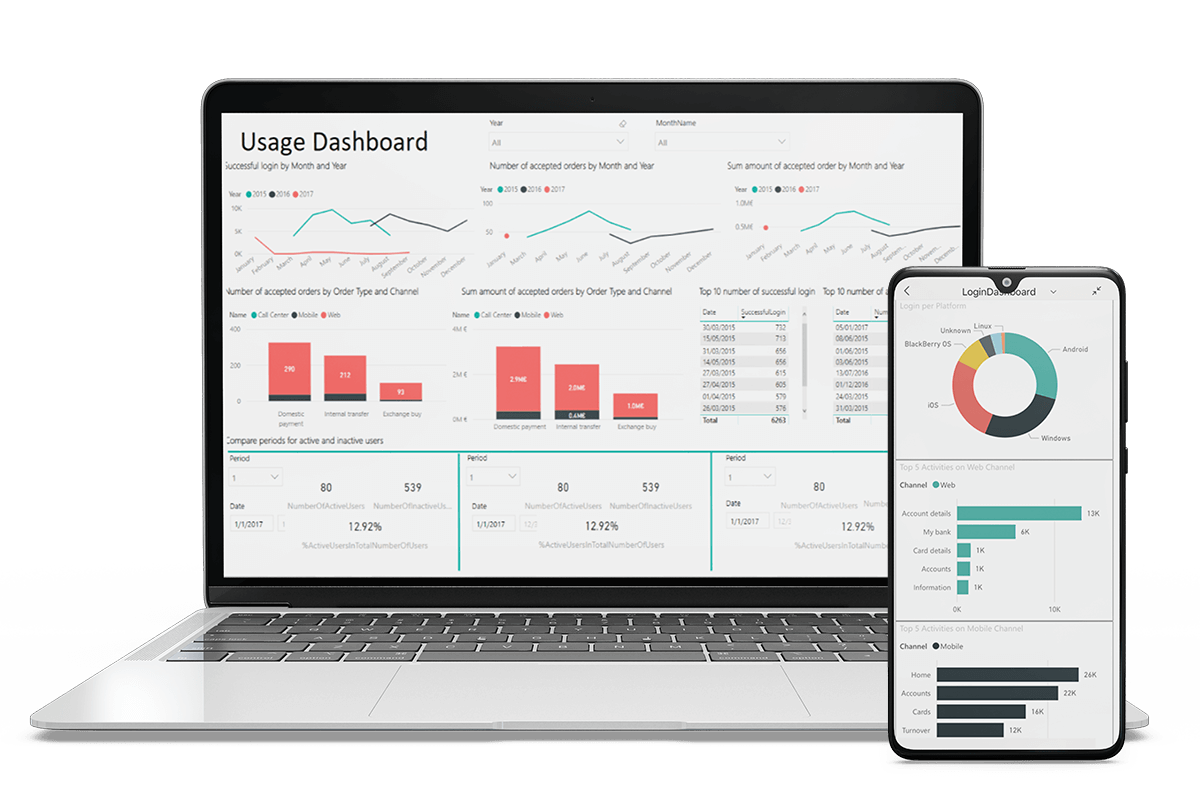

Digital Insights - Executive Reporting

Provide simple, convenient and 24/7 real-time access to your Digital Banking insights and statistics for banks Executives and Digital Managers. The Executive Reporting module includes more than 20 reports out-of-the-box, including:

- Numbers and percentages of digital users: Active Users, Returning Users etc. per platform, channel, location, time/date

- Engagement Rate – Popularity and usage of widgets and functionalities

- Transactions per month, per type, per channel, per user segment etc.

- Time Spent on Digital Channels

- Top 5 / Top 10 lists and benchmarks

- Most used functionalities

- Most time spent across different customer touch points

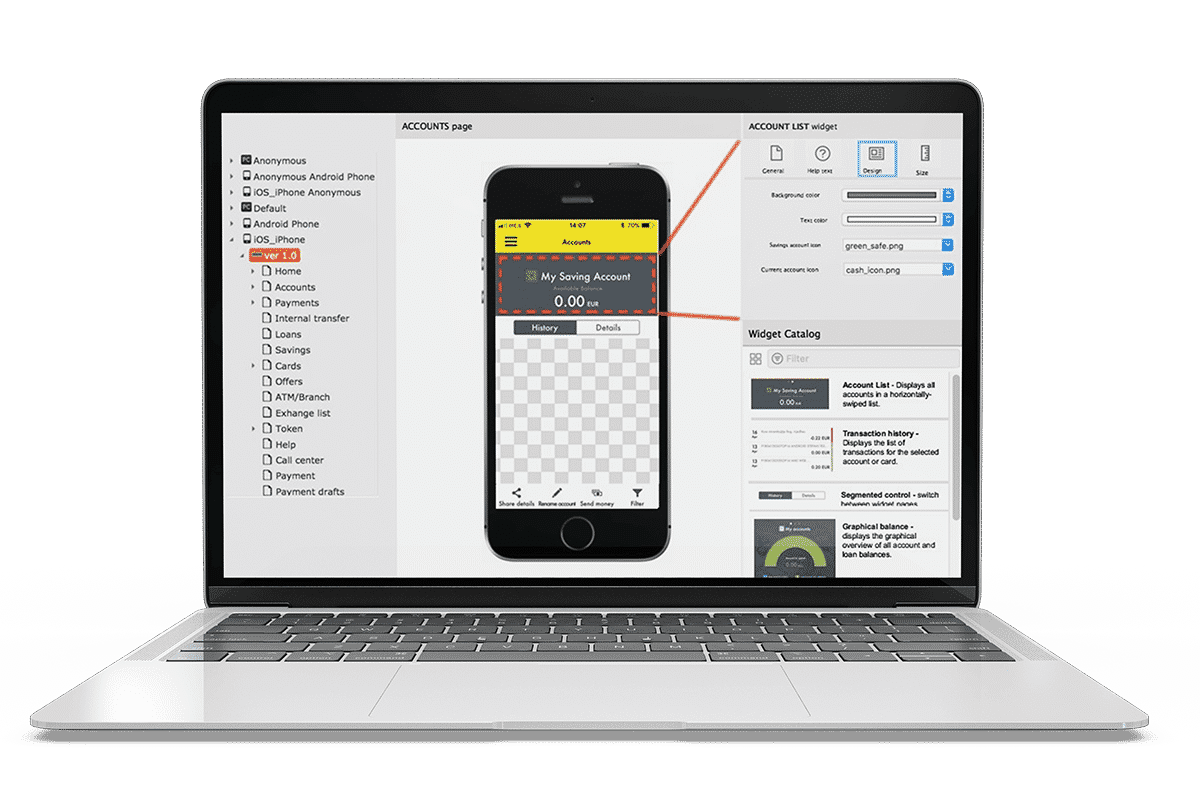

Customizability

- FINTENSE solution has been built with full customizability in mind – existing functionalities can be extensively customized both by the vendor and by the Bank, using FINTENSE SDK

- In contrast to standard native mobile apps which require users to download updates after any modifications, no matter how small, FINTENSE native apps support extensive customization and (re)organization with no need for submitting updates to app stores

- The Bank can change both the design and the user experience using visual tools, and such changes can be live and accessible to app users immediately, without waiting for the app update to be accepted and published.

Optichannel Platform

- All channels – web, mobile, smartwatch, kiosk, etc. – are administered from a single point

- The back-end infrastructure is shared among all channels, including the integration and data layers

- All actions performed on a channel are immediately visible and accessible on all other channels – for example, switching to another channel in the middle of loan application is completely seamless

Customer Segmentation

- Instead of having the same user interface for each customer, the Bank can create different designs and/or functionality layouts for each customer segment to best suit the needs of each particular group of users

- The segmentation and presentation of the appropriate design & layout is fully be automatic – the same app can contain designs and functionalities for all segments

- The customers are able to switch between layouts on their own, for example choose Basic or Advanced

- Creating and customizing designs and layouts for new segments is done completely through visual drag & drop administration tools and does not require updating the apps

On-Premise Deployment

Banking system can run on off-the-shelf servers, either physical or virtual, as well as on any combination of physical and virtual infrastructure. The number of required servers depends on the projected traffic and the number of active users.

Cloud Deployment

Major cloud hosting platforms, like Amazon AWS and Microsoft Azure are supported, as well as deployment in private datacenters

About us

Copyright 2021 NF Innova, All Rights Reserved. View our Privacy Policy & Terms of Use.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Powered by www.wowfactory.rs

Copyright 2021 NF Innova, All Rights Reserved. View our Privacy Policy & Terms of Use. Powered by WoWFactory

Book a Demo with NF Innova team!

We are looking forward to meeting you soon!