First part of this article: LINK

Article from the magazine “Biznis”

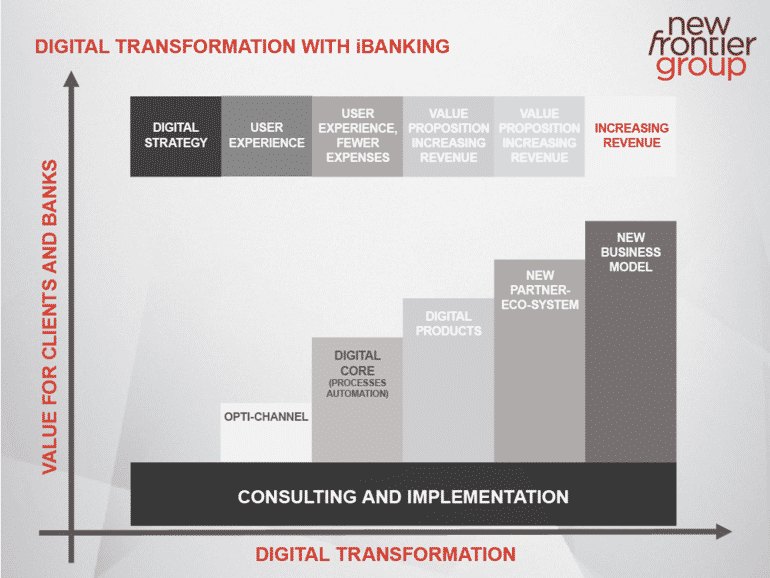

The third step is to create and define digital product in accordance with the established digital strategy, whether it is about new products that are suitable for digital channels, or old products that are adapted to the digital channels and automatically performed: new instant cash loans, robotic investment advisers, payments linked directly to the internet purchases, digital wallets, payments based on photos of the payment slip, a combination of sales and credit, etc. Digital products go with open two-way communication with clients. Critics, comments and suggestions for improving services or suggestions for new products bring great value to the bank and all clients. Communication must be easily accessible to everyone, include responses and ranking because transparency and openness are very important new features that accompany digital products and bring added value.

Innovation and good ideas are important for this third step of digital transformation, but every new product must be checked going through the first and the second step. Automation and opti-channel communication with customers should be provided. If the communication for any new product must be done separately for each channel, or if the process is not automated, time-to-market will be long and processes expensive. Thus, competitiveness and profitability are lower. This significantly reduces the chances of success for a new product.

The fourth step is linked to the partners. It is necessary to carefully analyze the existing partnerships and create a new digital ecosystem that will bring additional value to the user and the bank. For example, banks often offer their clients one type of insurance, although it is not an optimal solution, based on the price and the characteristics of services for each client and each occasion. The digital approach allows banks to assume the role of a platform on which to merge the two parties, such as customers and insurance, and offer multiple products from various insurance companies. Customers will get a wider choice and therefore added value. Banks gain the trust and loyalty of customers. Some banks have already implemented a platform model and offer a variety of services to their customers.

The fifth step is related to new business models. With selected partners, they can join loyalty programs to develop “White Label” banks or other digital brand banks and so on. All new models target customer acquisition and revenue growth and profits. A prerequisite is to always connect the first four steps, because if, for example, opening new accounts is not the automated or if cash loans are not automated, then new business brings unnecessary additional costs rather than profitability.

Lack of new digital products and the use of traditional procedures, in three projects of the “White Label” Bank of Polish banks and mobile operators have not made adequate financial effect.

The banks have the trust of clients, many points of contact with customers, their loyalty, capital and profit, the value of the people and processes. Digital strategy should be based on that and digital transformation started. It is necessary to achieve greater openness and transparency, better use of customer data to personalize offers and automate the most important processes and offer new digital products.

It is necessary to do so as new challenges are yet to come by introducing PSD2 standards, Block-chain technology and operating principles with immediate execution of complex transactions in the network of participants.

Changes should be initiated as soon as possible. Heraclitus thinks only change is constant. This is especially true for banks today.