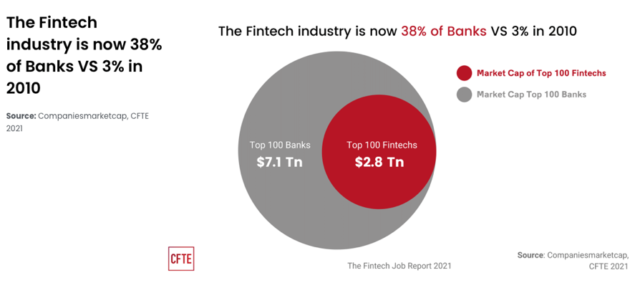

Top 100 Fintech and Neo-bank business organizations are now valued 38% of the value of top 100 Banks VS 3% in 2010 according to „The Fintech Job Report 2021“, published by Center for Finanace, Technology and Entreprenuership:

What are “SUPERPOWERS” that enable Fintech industry to close the gap?

The very first superpower is DIGITAL. They are converting physical operation and distribution of the money into digital data and software-based operations. Fintech’s communication and collaboration with clients and potential clients is using digital channels as their main if not exclusive channels. Fintech companies design, develop and operate in Digital world while traditional banks are operating in physical or hybrid world. And even when traditional banks are adding operation in Digital world very often their Digital is not really Digital. Read more in our blog.

Fintech industry has SPEED as superpower. Speed in hiring and supporting new digital talents to come up with new ideas and new digital development and implementation teams to realize them. Speed in going to market and converting new ideas into their software – digital financial products and services, into valuable offering for their clients. Speed in implementing changes and integrating 3rd party solutions into their value proposition. Speed in embracing open banking and collaboration with other Fintech organizations and banks.

Speed in operations with goal to achieve immediate fulfillment for every product and service for their clients. Compare digital services of the traditional banks and Neo-banks (our blog and Peter Ramsey case studies) for instance how long it takes to open the account in Neo-bank and in a traditional bank.

Fintech industry is ready to be INVISIBLE. They are ready to serve clients directly but also to offer Embedded financial services to their partners or SME and corporate clients. Payment solutions are integrated and embedded services into sales portals and platforms. Apple, Amazon, Stripe, Block (Square), Alipay offer different ways to support embedded payments. Buy Now Pay Later (BNPL) is offered as service on internet sites of many online sales portals and is integrated into portals. Take example of Klarna or Apple and many others who are introducing BNPL solutions. It can be a deferred payment up to 4 weeks or the loan for 3 and more months.

Embedded insurance is offered by telco’s, banks and companies from other industries. Buying smart phone can include insurance and even an app that would react automatically if the screen is broken and automatically will inform insurance company in that case.

Invisibility in financial services and other services is expanding fast because clients are not interested in getting a loan, but they want to buy goods, a car, or an apartment or… If the process of getting a loan is part of the purchase process, and is almost invisible for clients, that has higher value for clients.

How can traditional banks empower themselves with superpowers? One option is to include this way of increasing value proposition into their plans of digital transformation and engage their own IT or software solution partner to develop and include in their digital banking solutions SPEED AND INVISIBILITY.

Gregor Bierent, CEO of NF-Innova proposes another approach Product as a Service (PraaS). “It is about the “Speed Boat” approach, which enables banks to create bigger value for their customers by simple re-usage of SW product based functionalities.”

He explains the benefits that such approach brings:

- Standalone, very focused business functionalities to fulfil customer demands

- Easy plug & play into Customer’s existing SW platforms and applications – no replacement required.

- Complementing & optimizing service offering vs. full replacements of those as in the past

- Fast Return-On-Investment and value creation for Enterprise businesses

- Lower entrance barrier for new innovations – PoC ready!

- Fast time to market!

- Subscription & performance-based pricing models as basis for long term contractual relations

Onboarding, Cash loans for clients and new clients, Payments are only some of PraaS that enable embedded financial services and are offered to SME and Corporate clients to include them in their Internet and mobile applications. They can be combined with Augmented Reality or Virtual Reality to extend value for clients.

Branislav Vujovic

President of the Supervisory Board